Real Analytics

Serious real estate investment, whether it is direct capital or securities (such as REIT) investment, always requires analysis of vast amounts of data. The process becomes particularly more complex when the primary investment strategy is direct investment in real assets. Even if investors employ costly appraisals of real assets, the time-constrained decision process still requires a very quick, sensible, and objective analysis of economic conditions of markets of interest. Because time factor in investments is very costly, many investors recur to their business intuition, or what they call it “the gut feeling” or a hunch, only to discover their strategy leading to frustrated efforts, mediocre results, or realized losses. We never advise our clients to a decision to sell, hold, or buy a real estate asset or security to follow this kind of investment strategy, no matter how experienced they are. We advise always to conduct thorough analysis of the markets: rigorous, methodical, and objective analysis of all available information is a paramount step in devising and implementing a successful investment strategy.

At DVK Capital we know first hand that in real estate investments time and information is money. Capital investments constitute a big part of our business. To make optimal and timely investment decisions, we utilize the research of our Capital Analytics and Investment Research Division to understand real estate markets and their dynamics. As an investment firm specializing in advanced analytics and market research, we use complex mathematical models to help us make optimal investment decisions. Just as in our own business, we offer our clients access to the same market research, models, and analytic tools found on our website.

Real Analytics section offers real estate investors a set of analytic tools specifically designed to analyze vast market information quickly, to derive realistic asset pricing, trends, and depreciation, profitability and cost dynamics, expected investment returns and asset yields. These analytic tools eliminate time-consuming, costly appraisals of particular assets during the crucial investment decision phase. In addition to point-in-time pricing, the tools calculate trend forecasts of real assets, a unique glance into the future of investment performance based on continuously updated market and economic conditions, and incorporated into the mathematical models and tools on consistent basis.

Advantages

The idea to use analytic tools to price real estate assets is not unique. Many pricing tools are available from research firms or from the Internet-based companies. However, the single most important problem of these analytics is that their owners do not hold any vested interest in assuring their tools accuracy. Worse yet, they do not hold any investment risk in assets their models attempt to evaluate.

Serious investment firms always have an in-house economic and investment research in order to avoid conflicts of interests, problems of moral hazard, and disclosure of their investment strategies. This is also the case at DVK Capital. We utilize the same models and tools we provide to our clients to assess our own risks and to make our own investment decisions. As an investment firm, we hold direct vested interest and risks to assure our analytic methods, models, and tools provide the ultimate and optimal accuracy.

The second problem of other analytic tools is constituted in business models of companies that produce them. Because their business specialization is not investments, they often consist almost entirely of personnel lacking understanding of markets and their economy. This problem often times leads these companies to provide useless and inaccurate solutions of frivolous rearrangement of market trends. In contrast, DVK Capital as an elite investment firm employs professionals holding only advanced academic degrees directly applicable to research of real estate markets and investments, whose expertise directed towards making sense of market data and trends as well as advising our own business areas or our clients. All our research employees hold advanced degrees in economics, finance, statistics, mathematics, physics, or engineering, often complemented with extensive business experiences.

Advanced Real Estate Analytics

The main purpose of using advanced market analytics in investments is to extract subtle signals influencing markets and ultimately to approximate (it is impossible to know exactly what will happen in the future) their true, unobserved trends. While assessing massive market data series may reveal some trends, figuring out signals that actually drive markets requires advanced research based on specialized market expertise. In our own business experience, if the research is done with proper market understanding, the investment strategy is usually correct and optimal.

To assure accuracy of our analytics, we employ the latest, most advanced academic research in real estate valuation theory. Many real estate research firms, real estate companies, or appraisers claim the same approach, yet the majority defaults to old and established appraisal methodologies. These methodologies are classified in four main categories: sales comparison appraisal, regression analysis, cost approach, and income capitalization. Owing to the general availability of real estate market statistics, the first two are usually the preferred methods to value real assets. Over the years, the sales comparison appraisal has evolved to take advantage of technology and morphed into AVMs (Automated Valuation Models) such as CAMA (Computerized Automated Mass Assessment), minimum-variance grid method, neural networks, and hedonic models. The most basic sales comparison appraisal is still used today by real estate appraisers, and is the only official real estate appraisal accepted by lending institutions.

Although the sales comparison appraisal performs relatively well in the long-run and stable real estate markets with available comparable sales, the methodology fails to predict accurately real asset prices in markets experiencing cyclical economic swings. This is mainly due to the utilization of the principle of substitution, the main premise of comparative appraisal, which does not factor the volatility in preferences of economic agents in the changing economy. It is the reason the sales comparison appraisal tends to overprice or underprice real estate assets, thus hindering real estate market efficiency.

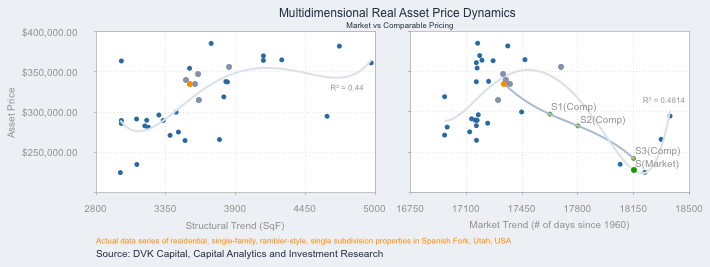

The chart above, as an example, shows the true market trend of comparable properties in three dimensions: structure, time, and price. (The three dimensions shown in the chart are chosen to simplify the example. The actual, multidimensional evaluation is complex and impossible to present in one chart.) The left panel shows the true market trend of an asset price from the standpoint of structural dimensions: the price of an asset follows the theoretical expectation that a bigger property is usually more expensive; the price of an asset increases at a diminishing rate, which is also consistent with microeconomic theory; the structural trend explains only 44% of variation in price of an asset since there are many more variables that affect real asset pricing. Overall, this structural price dynamic is well defined by the economic theory and, as seen in the left panel, follows similar trend in the real life.

The problem of sales comparison appraisal becomes evident when an asset is evaluated in the passage of time. In the right panel, the light-blue trend line explains 48% of price fluctuations, precisely because there are other economic factors that affect real asset prices in time. (Note, it is not the time factor that affects real asset price; time only reflects changes in other real factors affecting asset pricing.) The darker blue trend line shows the price of an asset in time using sales comparison appraisal, which is based on sales of similar properties compared to the subject property identified by a green dot, S (Market). It is evident that if the subject property were evaluated at different points in time using sales comparison appraisal, the methodology would dramatically devalue the property compared to the actual market equilibrium price (see S1(Comp) and S2(Comp)) and only catch up, somewhat, with the market trend after about a year and a half. One of the reasons the sales comparison approach fails to price accurately real assets is that asset factors depreciation (or appreciation--the marginal effects)--in this example the structural factor--are evaluated by a linear function, a phenomenon which very seldom occurs in the real life and contradicts microeconomic theory. (Note, the actual price trend as it appears in the right panel may not be linear because it depends on weights of comparable properties assigned by appraisers during price reconciliation.)

The sales comparison appraisal problem is compounded by the moral hazard (information withholding) problem, which afflicts the real estate appraisal business even though it is monitored by the AI (Appraisal Institute) standards. Utilization of AVMs introduces more objectivity into the real asset appraisal process and reduces valuation bias. These systems attempt to improve pricing predictions by improving valuation algorithms in comparable sales selection efficiency. Unfortunately, the majority of AVMs follow the same appraisal logic of the sales comparison appraisal by disregarding real economic trends and in their core perpetuate the same problem. The result, as shown in the chart, could be dramatic: an investor is forced to sell a property either low, or an asset is priced too high, thus making an investor loose time in trying to sell or buy at an unrealistic price.

Still other real estate valuation companies employ statistics in devising the commonly called hedonic models. In our experience evaluating these models, most companies disregard the complexity and rigor of mathematical science in defining these models, only to engage in useless numerology.

At DVK Capital we approach the real asset pricing task from the standpoint of investments. Everything on the market is commodified and follows the basic laws of supply and demand, especially in the light of volatility of economic signals. Not only is it important for an optimal investment strategy to price accurately a real asset but equally important is to predict its performance over time. Because of the illiquid nature of real estate, it is imperative for our own business and that of our clients to be able to price a real asset as close as possible to the true market equilibrium price in implementing an investment strategy and in order to react quickly to the dynamics of changing markets. This is exactly what our real estate analytics are intended to do. We are aware of advantages and limitations of every real asset pricing methodology and conduct rigors research to avoid falling into the same trap in our analysis of markets. Our clients’ and our own investments depend on the accuracy of our analytics. We have vested interest to assure rigorous and scientifically structured research of capital markets.